Mobile banking is one of the most fast-growing industries, where new trends appear every year. The COVID pandemic has catalyzed the growth of mobile banking, introducing even more trends into the industry.

With every passing year building a competitive mobile banking app is more challenging than before. In 2020 1.9 billion individuals worldwide actively used online banking services. This number is expected to grow up to 2.5 billion by 2024. As the number of users is rising, and the audience's tastes are becoming more and more demanding.

In this situation, you can't but follow the mobile banking trends.

In this article, I will talk about the mobile banking trends that are shaping the industry and which you can use to match users' needs.

Let's start!

What is a Mobile Banking App?

Before discussing trends per se, I think it is reasonable to clarify one essential thing – what exactly do we call a mobile banking app? In my practice, I have had to explain the difference between mobile banking and fintech apps many times, so this difference is not obvious itself. So let’s see the types of apps covered by the mobile banking category:

- Payment systems that help to carry out transactions online (for example: Paypal);

- Neobanking apps – autonomous mobile banking apps that help manage personal accounts, carry out transactions, bill payments, etc.

- Analytical financial apps are also apps that provide personal financial analytics, category management of expenses, etc.

- Crypto or Stocks Investing apps (for example: Coinbase, Binance, Robinhood).

Timeline of Online Banking

Here is the timeline of the most breakthrough development that happened to online banking throughout its history.

1983

The first form of online banking appeared in 1983 when the Bank of Scotland allowed customers to connect to television via telephones and pay bills. Back then, the only functionality available to users was access to the user’s profile and reviewing the private account. As simple as that.

1996

This was when banking made a big step forward. At this time, the first real internet bank appeared – Atlanta Internet Bank. The bank paid higher than average interest rates for not having physical bank branches.

2007

This year became the distinguishing moment for online banking, as it signified a new stage in the history of communication. Apple launched its legendary iPhone, which influenced a lot of industries. Particularly, it heralded the shift from internet banking to mobile online banking. Quick payments and instant access to accounts gained a lot of traction among users. Since then, the online banking industry as well as the number of mobile users is increasing with every passing year.

.avif)

Online Banking Now

After that, online banking went through colossal development. In 2010 it reached its peak when online banking officially grew faster than the internet itself! It was already evident that the industry needed more tech solutions to keep up with the users' requests.

This is how we came to what mobile banking is today – a fast-paced industry that integrates almost all the high-end technologies. As a result, today, it takes more than just an excellent product to make users like your product. It is less about the product itself but more about the user experience. And to provide a great user experience, you need to follow the main mobile banking trends.

7 Top Trends of Online Banking 2023

Now that the basics have been cleared out, let's look at the trends of mobile banking as they are now.

User-Centered Experience

It is no secret that during the last 15 years, all user-targeted services have undergone a revolution. The leading role in such services has shifted to users rather than the quality of service itself.

To become a user's favorite, you do not have to build a super tech-savvy and complicated service. You need to develop a mobile banking app with a convenient service that will allow users to complete their banking purposes efficiently, fast, and even have fun sometimes.

To achieve this simplicity and smoothness, you need to follow the user-centered approach. This is especially important, when your target audience is generation Z and Millenials.

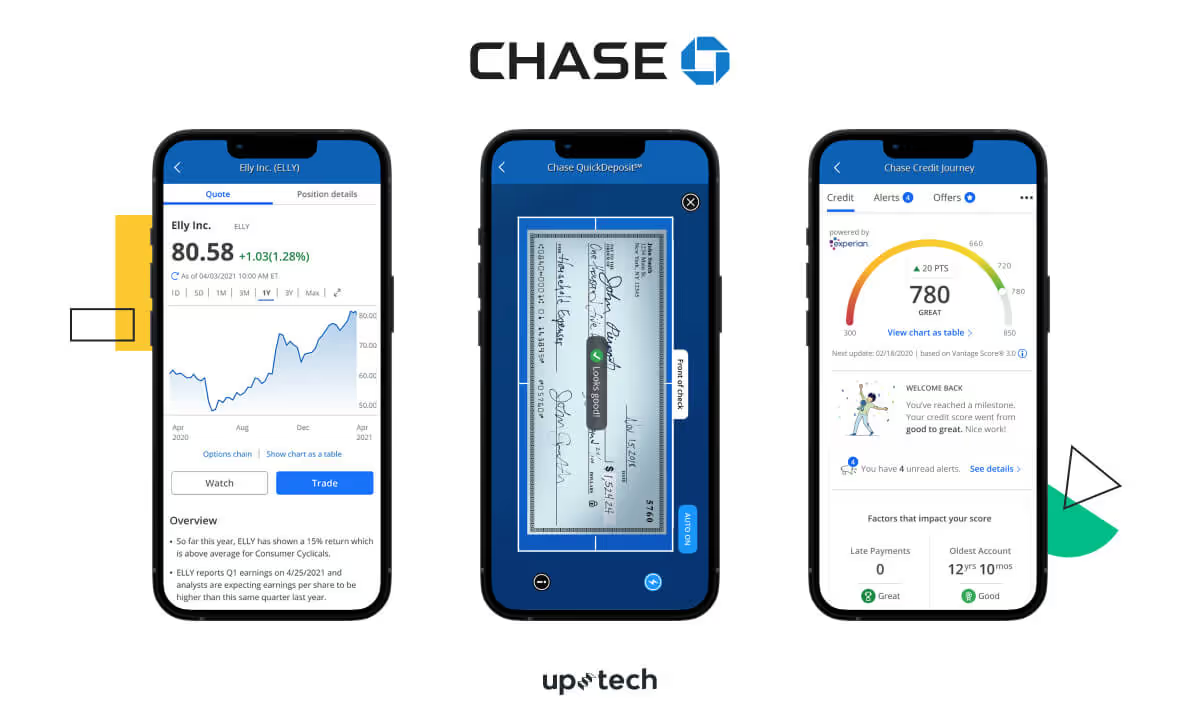

Look at the Chase banking app. It provides a totally customizable experience to users, like adjustable quick actions or alerts.

Open Banking API

Another trend disrupting the industry for the last few years is open banking. This unique technology allows a bank to share its banking information via APIs (Application Programming Interface) to third parties (startups), who can use them to build new fintech products, like financial analytics apps.

Open banking API is hitting the rails right now, as many countries are introducing open API regulations to streamline this process, like EU countries, India or US. Yet, many countries are only on the way to introducing open banking into their legislation. Anyway, this mobile banking trend is expected to shape the industry for years ahead.

Connected Money app is a vivid example of a mobile banking app, built using the open banking API. Connected Money was launched in May 2018 by a UK bank HSBC. The app allows users to view bank accounts of different banks in one app and manage loans, mortgages and credit cards.

Read more about open banking API in our article How to Integrate Open Banking API.

AI and Machine Learning

Can there be an article about trends without AI and Machine Learning? I doubt that. The thing is that both these technologies are popular among all tech industries, and online banking is not an exception.

Both machine learning and AI-driven software bring more customization to mobile banking and help to provide a better customer experience, which is highly important, as we mentioned earlier. For example, you could use AI on the front-end technologies to mimic live employees via chatbots, voice assistants, or personal recommendations.

BforBank, a neobank based by the Crédit Agricole group, is an example of a mobile bank that benefited from chatbots' deployment. To tackle the workload, BforBank integrated the chatbots, dynamic FAQs, forms, and contact pages. As a result, the neobank customers have 24/7 access to the service, and the total number of users on the app grew to an average of 850,000 visits a month.

Big Data

Big Data is a technology that allows the collection and processing of large amounts of personal user information. Like AI and ML, this is a viral technology used in many spheres for marketing, sales, or enhancing user experience.

Being data-related, big data has an ambiguous reputation. Especially in online mobile applications, big data is mistakenly seen as a threat to users’ security.

But will you be surprised if I tell you that big data helps users with their security in crime prevention? Well, this is true. While a mobile banking app tracks users’ activities in an app, it may easily spot if something unusual happens. For example, if a significant amount of money has been cashed or deposited – or any other unusual behavior for a particular user.

No Code/Low Code Development

This one is a gold mine for early-seed fintech startups. When you have limited time and budget limits for development, the best thing to do is build the simplest version of the product. In other words, a minimum viable product. No code/low code programs help you make a product’s MVP quickly and cost-efficiently and enter the product on the market as soon as possible.

Personalization

Personalization is a less apparent mobile banking trend but no less critical for sure. Today it is not enough to build a mobile banking app that functions well. It is also essential to make an app specifically for a particular group of people.

For example, a particular group can be gamers. So the product could be a special neobank for gamers, where users will get a cashback for any games-related purchase. The same can work for athletes or animal lovers.

Gamification

I can’t stress it enough – the user experience is the key to users’ loyalty. Properly designed and deployed gamification instruments make the user experience exciting and smooth. Gamification makes banking an enjoyable experience of plays, wins and awards for, let’s say, taking a loan or making a deposit. You can start your gamification integrations by introducing achievement badges and awards.

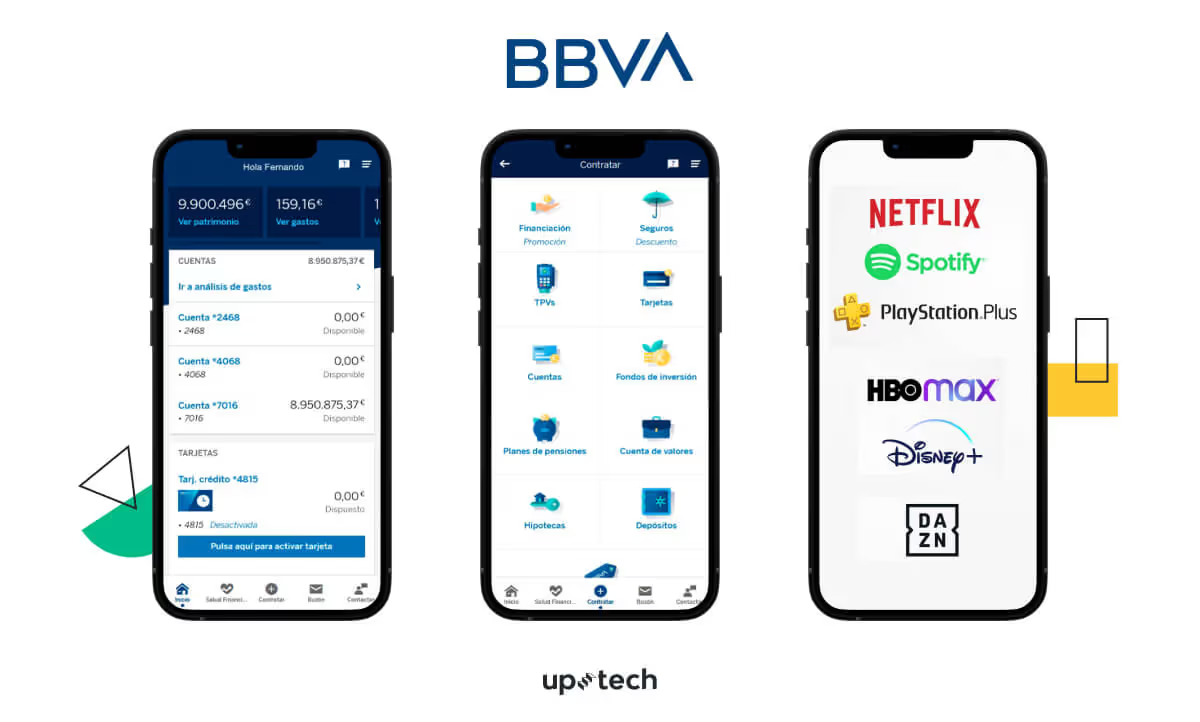

An example of a successful gamification case would be BBVA, a leading Spanish neobank. The bank took on a game-based strategy implemented in a BBVA Game. The app provides banking tutorials and explanations on how to make banking transitions, pay taxes or take loans. By completing the tasks, users get awarded with points, which they can use later to download music or stream movies.

Conclusion

Following mobile banking trends is a must for a co-founder of a mobile banking-related app. The truth is today, you need to be more than a talented entrepreneur to build a great app. You should also listen to users, feel their problems, and have a desire to solve them.

You cannot be an expert on every emerging trend in online banking. But you can always rely on tech experts and development teams who will help you make the right decisions and follow through with all the mobile banking trends.

Contact us, and we’ll talk about how to take your mobile banking app up a notch!

.avif)