Peer-to-peer digital payments remain the most popular segment among fintech markets. Hence, there’s a growing interest in PSP payment app development. The payments industry remains the most valuable part of financial services. According to the 2025 McKinsey Global Payments Report, it generates $2.5 trillion in revenue from $2.0 quadrillion in value flows, supported by 3.6 trillion transactions worldwide.

Developing a P2P payment app is not as easy since you’ll need to overcome many technical, security, and legal hurdles during the process. In this article, I’ll explain the challenges and how we tackle them to build secure P2P payment apps.

What is a P2P Payment App?

A P2P payment app is a digital platform that allows users to send money to “peers,” which are friends, families, or, in some cases, retailers. Peer-to-peer (P2P) apps provide the convenience of instantly transferring money between both parties without going through intermediaries.

The idea of cashless banking has enjoyed a popular reception during the COVID-19 pandemic. Since then, people have opted for a more hygienic option that does not involve physical cash. Payment apps allow them to connect and load an e-wallet with money from their bank or credit card, which enables cashless transfer to friends or retailers.

PayPal is one of the earliest digital payment platforms facilitating P2P money transfers via email. While it remains a popular option, the fintech revolution has seen newer competitors, offering distinct features with P2P transactions at its core. For example, Zelle, Cash App, Google Pay, and Apple Pay are notable payment apps that have emerged over the years.

P2P app statistics you should know

Check out these interesting figures if you need more convincing reasons to build a P2P payment app.

- In the digital payments market, user adoption continues to grow, with the number of users expected to reach 3.81 billion by 2030.

- Globally, about 1.3 billion adults remain unbanked, representing roughly 15–16% of the global population.

- People choose mobile payment apps more often, with global transaction volumes reaching $8.1 trillion in 2024.

- Sending money to family and friends continues to grow. According to the World Bank, global remittances rose by 4.6% in 2024, reaching $905 billion, up from $865 billion the year before.

- People increasingly prefer digital channels for money transfers. The World Bank & Visa Digital Remittances Report shows that 67% of users choose to send money digitally to bank accounts via apps, while 40% still initiate digital transfers from physical locations, such as banks.

- Digital wallets are set to further strengthen their position as a leading payment method in 2026.

Looking for financial software development services? We are here to help you. Contact us.

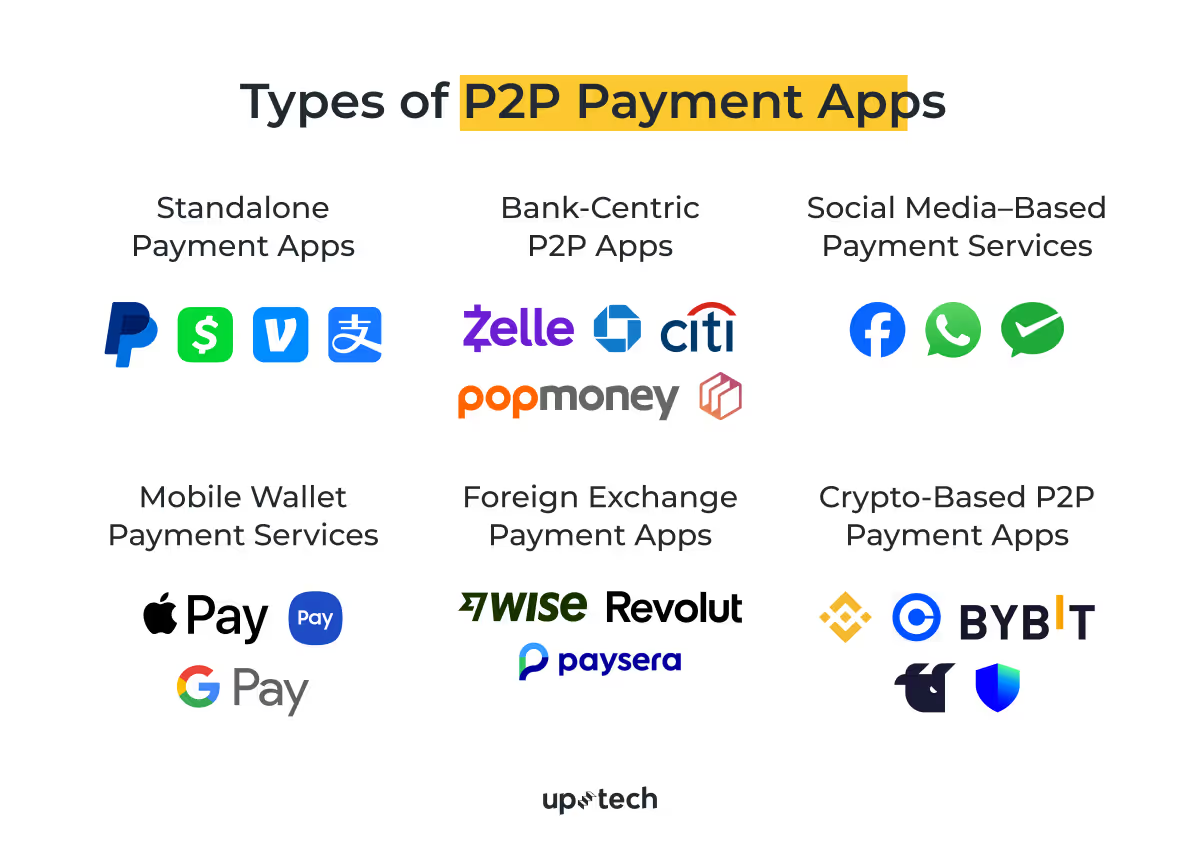

What are the different types of P2P apps

Before you pursue P2P app development, it's essential to understand the different variants and the market they serve.

Standalone payment apps

These apps operate as closed ecosystems with built-in digital wallets that allow users to store funds and send money directly to other users of the same app. Examples include PayPal, Venmo, Cash App, and Alipay. While users typically connect a bank account or card to add or withdraw money, transfers within the app happen instantly and independently of traditional bank-to-bank flows.

Bank-centric P2P applications

Banks have shown tremendous interest in the P2P app segment, and some payment apps are built with existing banking infrastructure in mind. For example, Bank of America’s Zelle is a popular P2P app that integrates with most US banks, allowing users to make cashless purchases with retailers.

Other examples of bank-centric payment apps include clearXchange, Chase QuickPay, Citi Pay, Popmoney, and Dwolla.

Social media-based payment services

Popular social media platforms are testing out the viability of doubling as a P2P payment app and hope to replicate the success of WeChat. Facebook Pay is available in the US, where users can send payments to their contacts without leaving the app. Meanwhile, WhatsApp runs a trial in India where users can send and receive money via a UPI ID or QR code.

Mobile wallets as payment services

Key players in the mobile industry have built their respective P2P digital payment ecosystems. Apple Pay, Samsung Pay, and Google Pay target users of their respective devices with payment services based on intrinsic hardware capabilities like NFC.

Foreign exchange payment app

As the name implies, the payment app allows users to transfer money to their peers, except in foreign currencies. Services like Wise, Revolut, and Paysera support multi-currency transfers and in-app exchange.

These apps are popular because they typically offer lower exchange fees and clearer rates than traditional banks, especially for international payments.

Crypto-based peer-to-peer payment apps

Crypto-based P2P apps are payment apps that let users send and receive money using cryptocurrencies instead of traditional bank transfers. Examples include solutions like Binance Pay, Coinbase Wallet, Bybit, WhiteBIT, and Trustee Wallet that allow value transfers directly between users through in-app wallets.

These apps are often chosen for faster and more affordable transfers, especially for cross-border payments. While crypto volatility can be a factor, many platforms support stablecoins, which makes everyday transfers more predictable.

Overall, crypto-based P2P apps are a good fit for crypto-native users and for anyone looking beyond traditional, bank-centered payment systems.

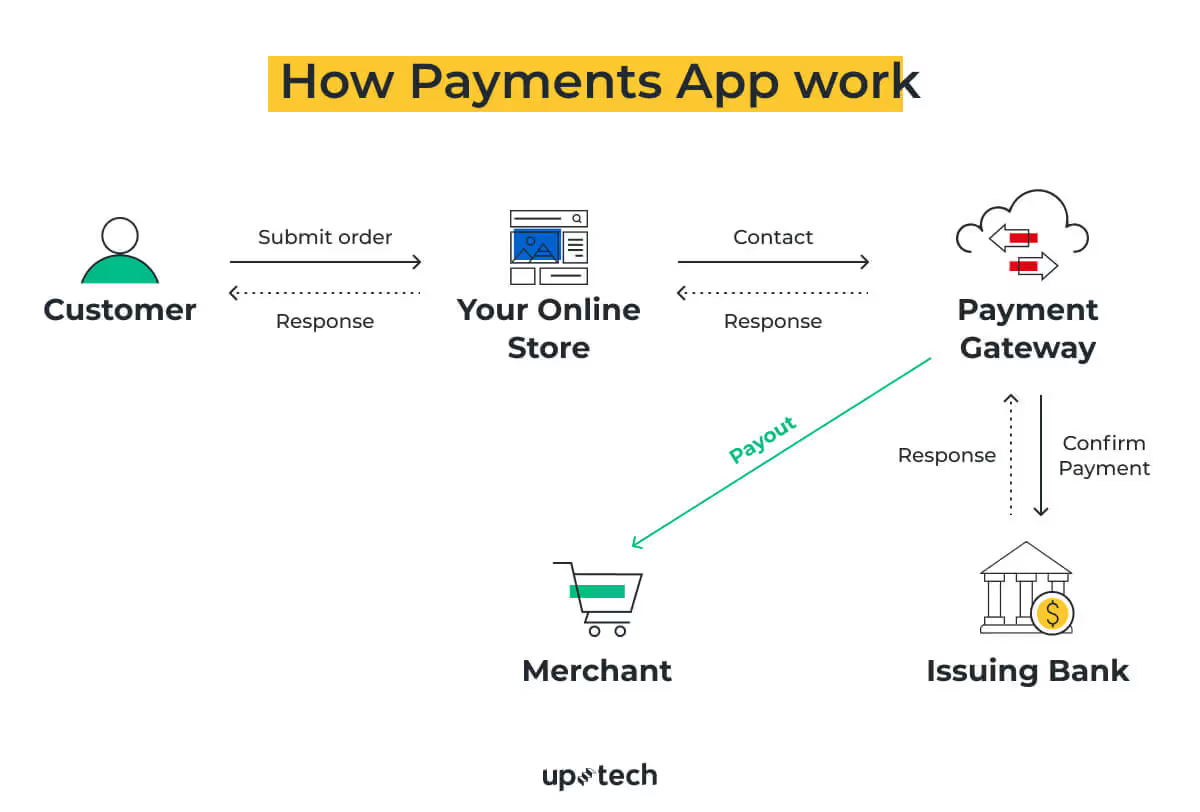

How Do the Payments Apps Work?

At a high level, a payment app connects the user, the payment gateway, and the bank. A customer initiates a payment in the app, the transaction is verified and processed through a payment gateway and issuing bank, and the funds are transferred to the recipient once the payment is confirmed.

Despite its convenience, the inner workings of a payment app are more complicated. Different payment apps might use different authentication, security, and payment gateways, but they share fundamental principles.

P2P transactions within the same app

The first option requires both parties to install the same payment app on their mobile devices. When you send payment to your friend, you would need to insert personal information, such as an email or mobile number. The transferred amount is deducted from your e-wallet and credited to the recipient’s payment app.

P2P transactions via payment links

In some cases, it is enough for only the sender to have the app installed. This is the second option for P2P transactions. The sender inputs the recipient’s details in the app, and the beneficiary receives a secure link. The recipient can complete the process through a web page without installing the app.

In-store payments using payment apps

Using payment apps for in-store purchases involves a different transfer mechanism. There are two ways of facilitating payment to retailers: NFC and QR codes.

- NFC involves transferring payment details with ultra-short-range radio frequency communication between the smartphone and a payment terminal.

- QR code payments use a scannable code that contains a unique identifier for the merchant or transaction.

NFC is the dominant payment model in the US, UK, and Western countries. Payment apps like Apple Pay and Google Pay use the NFC capability in smartphones to make payments to the retailer’s payment terminal. Meanwhile, QR code payment is prevalent in the APAC region, with Chinese-based Alipay leading the pack.

Regardless of the payment technologies, the payment transfer involves sending encrypted information to the payment processor, credit card issuers, or banks. This is done in a highly secure channel between the parties to ensure the transaction integrity is not compromised. In simpler words, the right amount is deducted from the sender’s e-wallet and added to the recipient’s balance at all times.

8 Steps to Build a P2P Payment App

Building a successful payment app takes careful preparation, execution, and further testing.

Here's how to develop a P2P payment app in 8 steps:

- Discover the market and conduct technical research

- Choose the P2P app type

- Study your audience

- Create the design

- Build the MVP

- Choose and develop the must-have features for complete development

- Test a P2P payment app

- Launch & improve constantly

Let’s take a closer look at each step.

Step 1. Discover the market and conduct technical research

As the founder, you must have a clear perspective on the problems you're trying to solve and ensure there's a demand for your products. This means studying the digital payment market you have set your sights upon. Analyze what your competitors are doing and determine how to add value to the highly competitive payment app market.

It’s also equally important to conduct deep technical research as a payment app is dependent on robust security, technological integration, and regulatory compliance. You must explore the available tech stacks and evaluate if they are sufficient for developing a technically sound payment app.

Not sure how to conduct initial research? Check out our article on Discovery Phase

Step 2. Choose the P2P app type

Then, decide the P2P app type that aligns with your business value, goals, and solution. Different P2P models solve different problems and come with different levels of complexity, regulation, and competition.

For example, some businesses are not keen on competing with established players like PayPal and Alipay in the standalone app segment. Instead, they may explore alternatives such as bank-centric or niche P2P solutions, where differentiation is easier, and trust is already built into the ecosystem.

Consumer-facing products with frequent peer-to-peer interactions often work best with standalone payment apps. In this model, payments are central to the experience, but success depends on strong branding, network effects, and user acquisition.

Businesses serving international users, freelancers, or remote teams often lean toward foreign exchange payment apps. These apps prioritize multi-currency support, transparent rates, and efficient cross-border transfers.

Step 3. Study your audience

You might introduce revolutionary ideas to the fintech space. Unless your audience agrees with your thoughts, you're on shaky ground when developing a P2P app. Run feasibility studies, conduct interviews, and hold surveys to ensure you're building an app that offers real value to users.

Getting on the ground with users helps you reduce the risks of launching a new app. Based on the interactions, you'll better understand important features, major pain points, and overlooked opportunities that help build an app that users want.

Step 4. Create the design

The design phase starts by structuring the feasibility findings into mind maps that paint the overall picture of the app. Based on the specification, developers work on the app's UX and UI while aligning the process with the business goals. They produce artworks depicting the layout of the app screens and optimize user interaction with various elements on the app.

By the end of this step, you will have a set of visually appealing screen layouts and descriptive user journeys that help users achieve their goals efficiently. The idea is now represented in interconnected code wireframes, awaiting further development in the next step.

Step 5. Build the MVP

It's prudent to test the market with an MVP (Minimum Viable Product) instead of launching a full-blown feature-laden app. This is the stage where developers are involved in coding, technology integrations, and testing to produce a functional app for users.

Development typically happens in short iterative sprints, with continuous testing and early user feedback to validate the MVP and refine functionality.

Step 6. Choose and develop the must-have features for a complete P2P payment app development

At this stage, define the core features your payment app needs to function reliably and meet user expectations. These features form the foundation of the product and directly influence usability, security, and trust.

Building a payment app often requires expertise in API integration to connect the app with different cloud services. Blockchain and AI (including generative AI services) are also common fintech technologies that act as the foundation of the payment mechanism.

Below are the essential features most P2P payment apps include.

- Send and receive money. Users should be able to transfer available funds from their in-app wallet to other users and receive money just as easily.

- Transfers and payouts. The app should support local and, where relevant, cross-border transfers to banks, payment gateways, or external service providers, including multi-currency flows.

- Banking integration. In addition to P2P transfers, the ability to send funds to bank accounts improves flexibility and makes the app easier to use in everyday financial scenarios.

- Transaction history. The app must store accurate, immutable records of past transactions, with filters by date, amount, or transaction type.

- Spending analytics. Expense summaries help users understand their spending over time. Some apps extend this with savings goals or cashback features to encourage better money management.

- Notifications. Real-time notifications keep users informed about transactions, account activity, and important status updates.

- Payment and invoicing. Support for bill payments or invoicing allows users or businesses to request and collect payments directly through the app.

- Multi-factor authentication. Security measures such as OTPs, PINs, and biometrics help prevent unauthorized access and accidental fund transfers.

- Biometric identification. Fingerprint or face recognition adds an extra layer of protection and helps secure sensitive financial data.

- In-app messaging (optional). For social or P2P lending apps, built-in messaging keeps payment-related conversations in one place and tied to transactions.

- Customer support. In-app support, including chatbots and a knowledge base, helps users resolve technical or transactional issues without leaving the app.

Defining these features early helps prioritize development work, avoid overbuilding, and ensure the MVP delivers real value before adding advanced capabilities.

Step 7. Test a P2P payment app

Testing is critical for any P2P payment app, since even small issues can affect user trust or cause transaction failures. Before launch, the app should go through several test cycles to confirm that payments, balances, and integrations work as expected.

This step usually includes functional tests for core flows such as send and receive money, security tests with a focus on mobile app security, and integration tests with banks, payment gateways, and third-party services. Performance tests help verify how the app behaves under high transaction volume.

Step 8. Launch & improve constantly

Launch your payment app with optimism, but be watchful for potential issues. Monitor feedback and analytics to identify bugs and expedite fixes. Even if you have managed to iron out the teething issues, it's vital to improve the app based on changing trends. Engage your developers periodically about introducing new features or modifying existing ones to meet market demands.

Common Pitfalls Of Developing a Payment App

I have to be frank that building a P2P payment app is considerably more challenging than other commercial apps. Some concerns must be addressed early on as they’ll affect the eventual release of the app.

Fraud risks

The challenge:

Payment apps act as direct financial touchpoints. Users may hold thousands of dollars in their e-wallets, which makes these apps a prime target for fraud, account takeovers, and unauthorized transactions.

The solution:

Strong access controls such as two-factor authentication, PINs, and biometric verification reduce the risk of unauthorized access. End-to-end encryption protects payment data during transfer between devices, servers, and payment gateways.

AI-based fraud detection systems can also analyze transaction patterns in real time and flag suspicious behavior before damage occurs.

Data security

The challenge:

Users trust P2P payment providers with sensitive personal information, transaction history, and financial data. Any data leak or misuse can lead to legal issues, reputational damage, and loss of user trust.

The solution:

Payment apps require strict data protection practices, including secure cloud infrastructure, access controls, and encrypted data storage. A clearly defined privacy policy helps users understand how their data is stored and used, while internal security audits reduce exposure to vulnerabilities.

Regulatory compliance

The challenge:

Payment apps operate in a heavily regulated environment. Every feature must align with financial and data protection regulations across regions, which increases development complexity.

The solution:

Compliance requirements such as PCI DSS for card data and KYC and AML rules must shape both architecture and feature design from the start. Regular compliance reviews and legal consultation help prevent costly rework or delays after launch.

Growth and scalability limits

The challenge:

A successful launch often leads to rapid user growth and higher transaction volume. Without proper scalability, the app may suffer from slow performance, service outages, or failed transactions.

The solution:

Scalable cloud infrastructure, modular architecture, and microservices help the system handle increased load. Separating financial calculations from the core payment flow reduces pressure on critical components and improves stability as usage grows.

Technological gaps

The challenge:

A P2P payment app combines multiple technical components, including wallets, encryption, APIs, databases, and sometimes blockchain. This level of complexity requires coordinated work across disciplines.

The solution:

A dedicated development team with experience in fintech architecture, security, and integrations is essential. Clear system boundaries and well-defined interfaces reduce risks during development and future updates.

Product versatility

The challenge:

User expectations in mobile payments change quickly. A solution that only supports basic P2P transfers may lose relevance as users adopt new payment habits.

The solution:

Regular product reviews and user feedback help guide feature expansion. Support for integrations such as merchant payments, subscriptions, or third-party services allows the app to evolve without major architectural changes.

How Uptech Can Help to Build Payment Apps

Uptech has a long-standing record of helping startups develop and launch successful payment apps to the market. Our team consists of multi-disciplinary software experts skilled in fintech technologies necessary to create digital payment solutions. Our in-house expertise includes blockchain, smart contracts, and AI (including AI consulting services in this domain), some of the most critical technical skills for the growing fintech market.

Besides building cutting-edge solutions, we consider the human part of the equation in earnest. We conduct feasibility studies and usability tests and leverage the feedback to produce apps that engage with user needs. Furthermore, we understand time sensitivity, budget, and business goals alignment for our clients.

Uptech converges technologies, teamwork, and valuable opinions to build successful P2P payment apps. One of our finest works is GreenFi (formerly Aspiration), a socially-conscious virtual bank with zero-fee transfer facilities. Our team helped the US-based startup realize its idea from scratch with brainstorming, validation, coding, testing, and post-launch support sessions.

.avif)

Another example of our fintech experience is our work with Presidio Investors, a US-based investment company. Our team automated investment data processing and deal analysis with AI. Secure AI workflows integrated into existing systems reduced manual effort and improved operational efficiency. This project highlights how we use AI, strong data protection, and scalable architecture to support complex financial operations and build reliable, future-ready payment and fintech products.

Summary

I’ve shown you everything you ought to know about building a P2P payment app. Launching a successful digital payment app takes considerable effort, but an adept development partner smoothens the journey. Considering that fintech is still a fast-growing industry, you’ll want to take advantage of every opportunity.

We’ve shared similar success with our clients, and we’re confident that we could do the same for you. Talk to us and get your journey started.